How To Show A Voided Check In Quickbooks In The Register

Properly voiding checks in QuickBooks Online keeps your bookkeeping records authentic. This, in turn, protects your business from fraud and helps you ensure your financial statements are always correct.

Although deleting a check accomplishes the aforementioned thing on your financial statements as voiding one does, deleting checks also compromises your recordkeeping and opens the door for potential errors. Deleting checks too makes information technology harder for you to find fraud on your account. The only time a check should exist deleted is if a duplicate entry was made by accident.

The process to void a check in QuickBooks Online is like shooting fish in a barrel and straightforward. It merely gets tricky when you take to void a check written in a prior accounting year. If you lot're hesitant to tackle voiding a cheque written in a previous year on your ain, achieve out to a QuickBooks ProAdvisor or a bookkeeper or accountant well-versed in QuickBooks Online. They volition exist able to walk you through properly voiding your specific transaction so your bookkeeping stays authentic.

What it ways to void a check

When you void a paper check, it means that particular bank check is no longer valid for payment purposes. This applies to both the physical check itself and also the bank check number associated with the cheque.

Simply writing "VOID" across a check gives y'all some protection against fraud. Nonetheless, sophisticated fraudsters can notwithstanding use the data on the check to create fake checks on your account or to fix up electronic payments and transfers. For this reason, you lot must be very conscientious most protecting checks yous take voided. The best style to protect these checks is to either shred them or file them securely.

Properly voiding and protecting paper checks is simply one stride of the process, though. You need to keep a record of the voided check inside your bookkeeping arrangement to help yous catch whatsoever attempt to use that check number over again. Call back, when yous void a cheque, the physical check itself and the bank check number associated with the cheque are both rendered invalid.

When yous void a check in QuickBooks Online, you lot tin can easily meet if that cheque is presented for payment once again. And quick detection is key to protect your account from fraudulent activity.

Voiding vs. deleting

From an accounting perspective, there'due south no real departure between voiding and deleting a check in QuickBooks Online. Voiding and deleting reach the same affair: Both deportment remove the touch on of the transaction on your financial statements. From a recordkeeping perspective, it's much better to void a cheque than to delete information technology.

For case, let'due south say y'all candy a $150 payment using check #1223 to the company that cleans your office. When you lot present the payment to the head of the cleaning crew, she delivers some expert news: Y'all've been extended a loyalty disbelieve, and your service now only costs $135/week.

Y'all cut a new bank check (#1224) for $135 and record information technology in QuickBooks. Merely now you accept to go the $150 payment off your books.

When you recorded the original payment using the Check screen in QuickBooks, the post-obit entry happened "behind the scenes":

-

Debit: Cleaning Expense $150

-

Credit: Checking Account $150

-

Check #1223 was also added to your Check Register.

If you delete the check, three things will happen:

-

The original debit and credit for $150 volition be wiped out of your accounting records, and your profit and loss statement will prove simply the new payment for $135.

-

Your Cheque Annals will also be updated to bear witness the correct available balance in your checking account.

These two things are fine. In fact, this is exactly the aforementioned thing that would happen if you voided the check.

However, another affair will happen and this is where you could have a trouble:

-

Deleting the check also means there is no longer any tape of it in your accounting organisation.

Your Check Register volition now spring from check #1222 to #1224. If you try to record another bank check using #1223, you won't receive a duplicate check number warning. This means you run the risk of creating future checks using incorrect check numbers. Now you accept a potential nightmare during reconciliation because y'all could accept multiple checks in your organization with the same bank check number. It also means someone could potentially create a forged check using #1223, present it for payment and y'all'd be less likely to take hold of the fraud.

If y'all void the bank check instead of deleting it, you retain a tape of check #1223 in your Bank check Register. It now shows $0 (and the debit and credit are zeroed out besides, instead of simply disappearing). This lets you keep an authentic record of all your transactions instead of having to remember what actually happened with check #1223.

Probable the only time a check should exist deleted is if you lot accidentally indistinguishable an entry — similar if you forgot you entered check #1224 for $135 and enter it again. If you void a cheque, actually use the features in QuickBooks Online to properly void the check (there is one exception to using the void features, which nosotros'll cover afterwards).

How to void a check in QuickBooks Online

Information technology's easy to void a check in QuickBooks Online. Not only does voiding checks keep your profit and loss statement and Check Register accurate, but if you lot employ QuickBooks Online'due south accounts payable features properly voiding checks ensures your A/P records are always accurate, as well.

Void a check already recorded

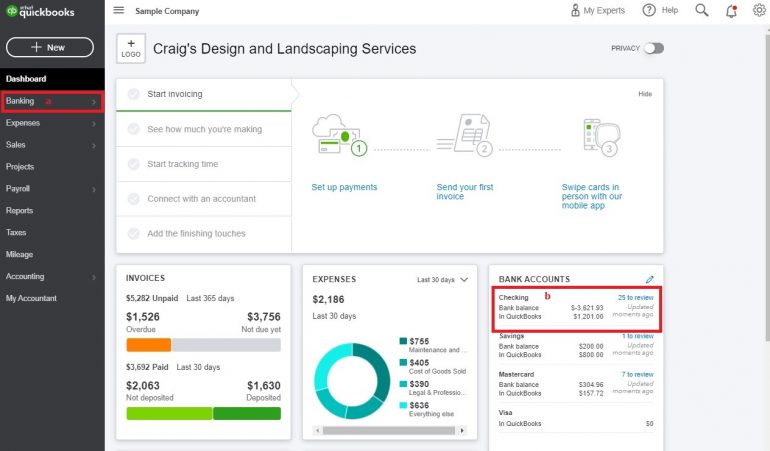

1. Locate the check you want to void. The easiest way to do this is by going to the Check Register. From the Dashboard, either (a) click on Banking in the left-hand toolbar or (b) click on the bank business relationship nether Bank Accounts on the right side of the screen.

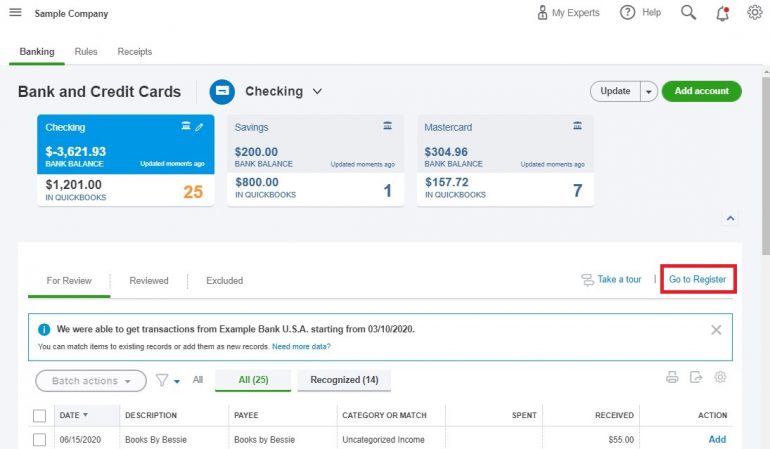

Click on "Go to Annals" on the next screen.

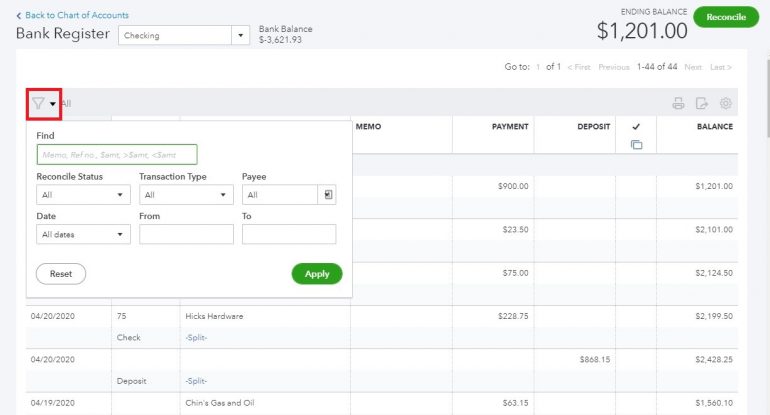

Search for the check you lot want to void, using the filters if needed:

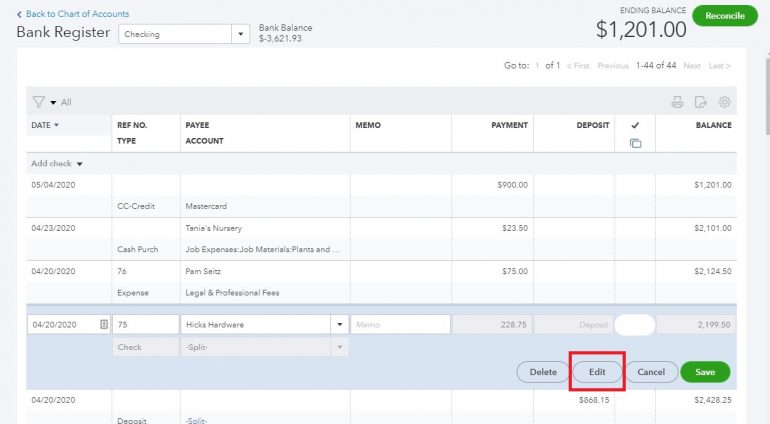

2. Click into the check line in the Annals, and so click the Edit push button.

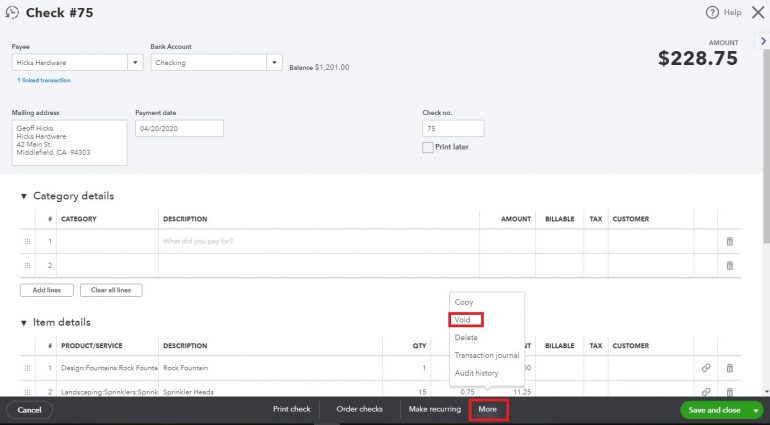

3. Click More than at the bottom of the next screen, then select Void.

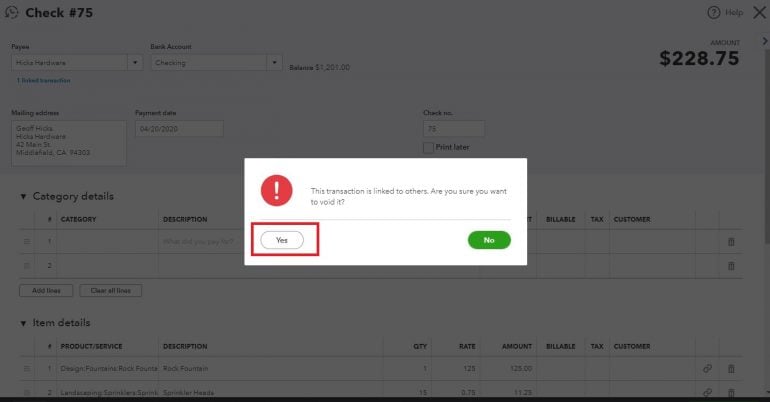

iv. Click the "Yes" button on the dialog box. The warning lets you know the bank check was used to pay a nib. When you click Yes, the payment is voided, and the pecker is updated to bear witness as open and payable on your A/P reports.

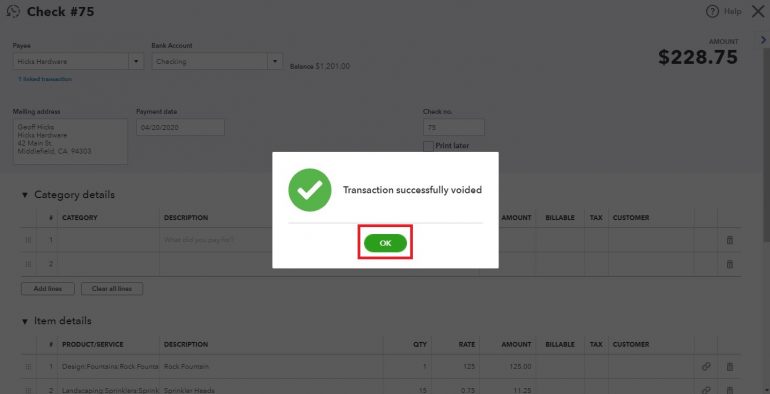

5. Click the "OK" push.

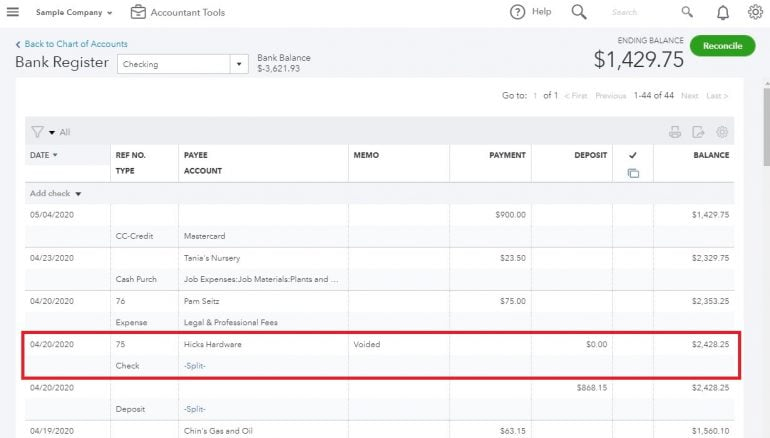

half-dozen. Review your Cheque Register. You'll now see the cheque shows $0 and voided.

Void a check not previously entered

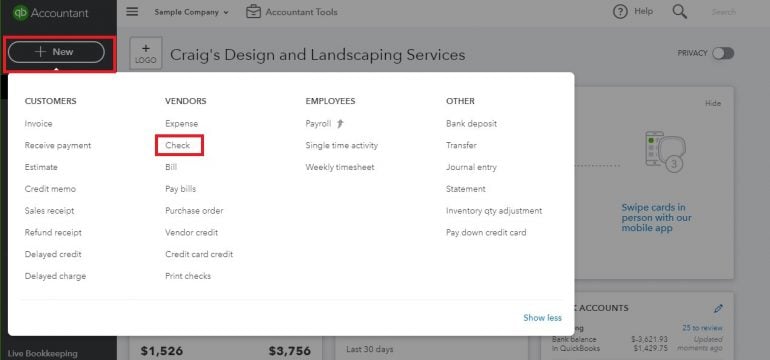

1. Click the "New" button on the Dashboard, then select Check under Vendors.

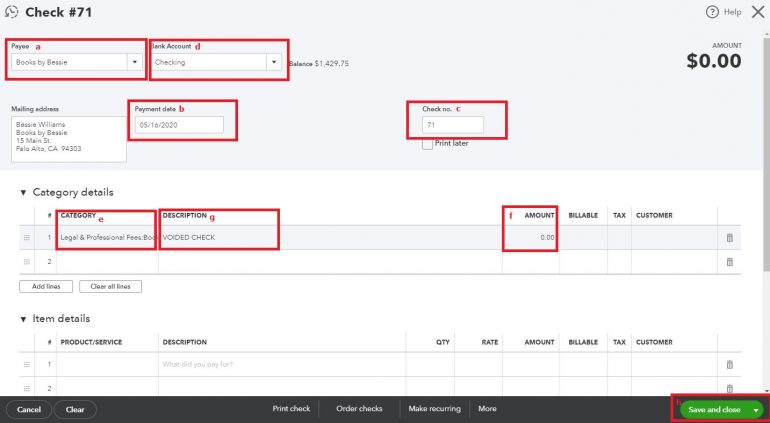

2. Create the check as usual. Fill in the (a) payee name, (b) date the cheque was written and (c) check number. Make sure you've selected the correct (d) banking company account. The (e) category isn't terribly of import, but it cannot be left bare. Finally, enter an (f) amount of $0.00 and note in the (g) description box that it is a voided cheque. Finally, click the (h) "Save and Shut" button.

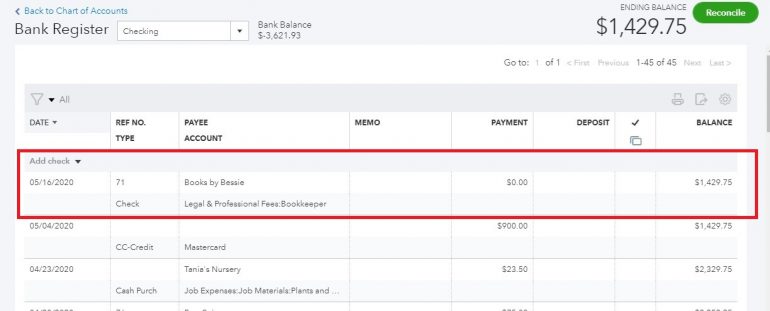

3. Review your Check Annals. You'll at present run into the bank check shows $0 and voided.

Fifty-fifty if you lot voided the check because a vendor or customer required it to set up electronic payments for your business, we recommend following this process to void the check number in QuickBooks Online.

Quickbooks Online

Void a check from a prior bookkeeping period

There is an exception to using the QuickBooks Online features outlined above to void checks. When you lot discover a check needs to be voided from a prior accounting period, yous will need to follow a dissimilar procedure to continue your records accurate. This revised procedure isn't necessary if the check to be voided was written in a previous month. Nevertheless, if it was written in a prior year, and if the books for that year accept been closed, you will want to use this amended process.

Using this amended procedure volition prevent changes to your closed books while still keeping your bookkeeping accurate.

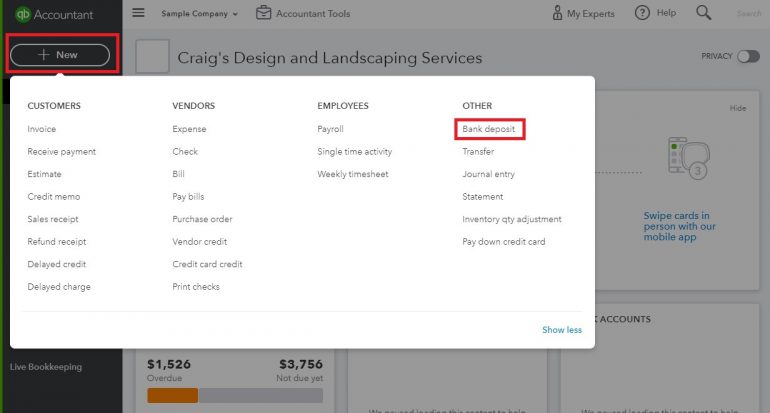

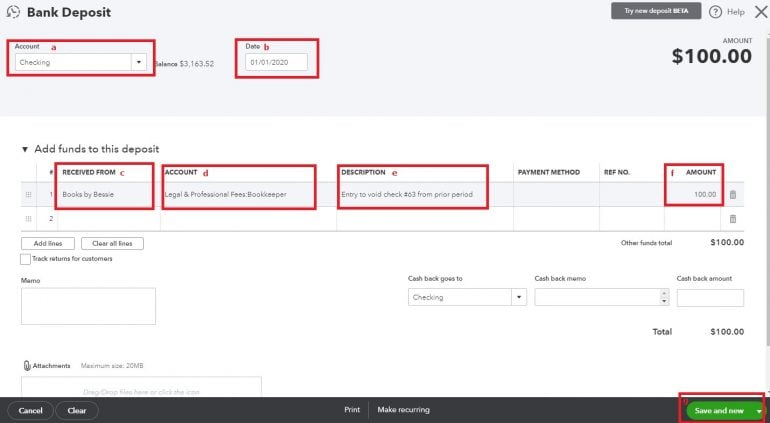

one. Create a deposit to beginning the bank check to exist voided. Click the "New" push from the dashboard, then select Bank Eolith under Other.

two. Fill out the Depository financial institution Eolith form equally usual. Make sure you select the correct (a) banking concern business relationship and set the (b) date to one in the current accounting year. Use either 1/1 or 12/31 of the current accounting yr to make it easier to observe this adjusting entry. In the (c) "received from" field, enter the vendor's proper noun to whom the check was written. Utilise the aforementioned (d) account yous used on the check you're voiding (you can create a multi-line deposit if the original check was carve up over multiple chart of accounts categories), and in the (due east) clarification enter "Entry to void bank check #(check number) from prior flow." Y'all can leave the "Payment Method" and "Ref. No." fields blank. Finally, enter the (f) amount of the original cheque and click (g) salve.

3. Mark both the original check and the eolith you only created as reconciled. You lot can either exercise this during your next reconciliation, or you can mark the transactions reconciled in the check register.

If the voided check was used to pay a beak that is withal due, you volition demand to create a new bill, dated in the current accounting year (use ane/i of the current year to make the adjustment easier to find).

Keeping reconciliations accurate

If y'all void a check that has previously been reconciled, you volition demand to undo the reconciliation and then reconcile the account over again, this time selecting the correct transaction for your reconciliation (you will never void a reconciled check.)

Nonetheless, voided checks will keep popping upwardly on your banking company reconciliation screen unless they are marked every bit reconciled. If you take a lot of voided checks, this will make your reconciliation screen cluttered and could perchance lead to mistakes.

Either marking your voided checks as reconciled in the check annals or select these $0 entries during your side by side reconciliation.

QuickBooks Online resource

Read more well-nigh how QuickBooks Online works.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

How To Show A Voided Check In Quickbooks In The Register,

Source: https://www.nerdwallet.com/article/small-business/void-checks-in-quickbooks

Posted by: andersoningdp1959.blogspot.com

0 Response to "How To Show A Voided Check In Quickbooks In The Register"

Post a Comment